Senegalese gold project could be quite lucrative for Fortuna

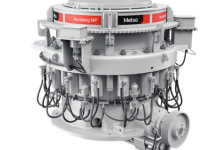

A preliminary economic assessment (PEA) commissioned by Fortuna Mining Group for the Diamba Sud Gold Project in Senegal supports robust project economics for the development of an open-pit mine and conventional carbon-in-leach (CIL) processing plant.

At a gold price of $2,750 per ounce, the assessment unveils after-tax net present value, using a 5% discount, of $563 million, an internal rate of return of 72%, and a payback period of ten months. During the first three years of production, Diamba Sud is projected to deliver an average of 147,000 ounces of gold per year at an All-In Sustaining Cost1 (AISC) of $904 per ounce.

Construction capital cost is estimated at approximately $283.2 million. Project funding is derisked by the strength of Fortuna’s balance sheet and robust cash flow generation. As of the end of the second quarter of 2025, Fortuna reported liquidity of $537.3 million and a net cash position of $214.8 million.

Jorge A. Ganoza, President and CEO at Fortuna, commented, “The PEA highlights the strong value Diamba Sud brings to Fortuna’s portfolio, using a long-term gold price of $2,750 per ounce. With permitting and the Definitive Feasibility Study underway, we expect to make a construction decision in the first half of 2026.” Mr. Ganoza continued, “Ongoing exploration is advancing with five drill rigs focused on expanding open areas of mineralization and to upgrade the small portion of Inferred Mineral Resources to the Measured and Indicated categories by year-end. With continued exploration success, we expect to enhance Diamba Sud’s life of mine production profile beyond a decade.” Mr. Ganoza concluded, “Additionally, we have approved a $17 million budget to advance early construction works, including the expansion of camp and ancillary facilities, as well as detailed engineering activities.”