Wheaton Precious Metals, Allied Gold ink US $175M deal for Kurmuk gold project

Wheaton Precious Metals (TSX, NYSE: WPM) has entered into a gold streaming agreement with Allied Gold (TSX: AAUC) for the Kurmuk Gold Project in western Ethiopia, marking a significant milestone for both companies and Ethiopia’s mining sector.

Wheaton will pay $175 million in four equal installments to Allied Gold and will receive 6.7% of the project’s payable gold, reducing to 4.8% after 220,000 ounces are delivered. Wheaton will also pay 15% of the spot gold price for each ounce delivered. Allied retains an option to buy back the stream.

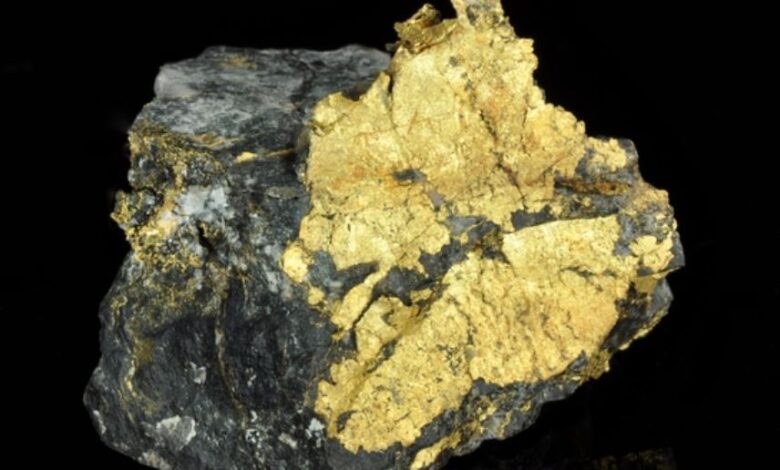

The Kurmuk project

The Kurmuk project will be the country’s first commercial-scale gold mining operation. Expected to commence production in mid-2026. Average life-of-mine production is projected at 240,000 ounces of gold annually. The deal is forecast to yield an average of 16,000 ounces of gold annually for Wheaton during the first decade of operation.

The project spans 1,450 km² and includes the Dish Mountain and Ashashire deposits, with further exploration potential. Wheaton Precious Metals is set to gain an estimated 180,000 ounces of proven and probable gold reserves. They will add 30,000 ounces of measured and indicated resources and 20,000 ounces of inferred resources.

On the other hand Allied Gold, secures critical funding for the Kurmuk project’s development and advances Ethiopia’s mining sector, creating local economic and social benefits. Peter Marrone, CEO of Allied Gold highlighted the importance of the streaming agreement and additional financing from the lending syndicate for project development. Randy Smallwood, CEO of Wheaton emphasized the project’s quality and potential to bolster local communities while advancing Ethiopia’s metals and mining industry.