SEIFSA initial report on the impact of United States tariffs on the metals and engineering sector – update 2

On 7 July 2025, the United States announced a 30% import tariff on South African exports, effective 1 August 2025. This development has prompted widespread concern within the South African Metals and Engineering Sector, which relies on the United States for approximately 8% of its total output.

To assess the likely implications, SEIFSA conducted a snap survey across its membership base. This report synthesises both the quantitative and qualitative feedback received, identifying direct and indirect impacts on companies, market alternatives being considered and notable initial perspectives emerging from the sector.

Key quantitative highlights

126 member companies responded to the survey, the self-reported exposure to the new United States tariffs can be categorised as follows:

- Directly affected (revenue/ job losses): 33.3%

- Indirectly affected (supply chain/ economy): 23.8%

- Exploring alternative markets: 15.9%

- Uncertain impact: 14.3%

- Unaffected: 12.7%

These figures show that while not every respondent is directly exposed to the tariff, a majority anticipate either direct or cascading economic consequences, demonstrating the interconnectedness of the metals and engineering ecosystem.

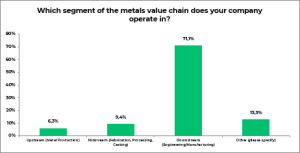

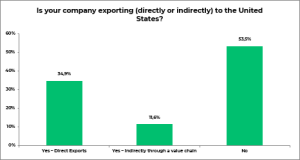

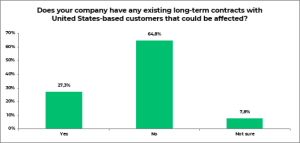

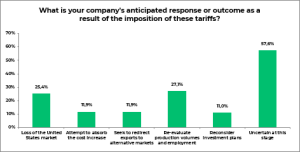

Below are graphs depicting the responses received:

Thematic summary of open-ended responses

- A significant number of respondents reported that the new tariffs would have severe and immediate consequences for their businesses. Many companies anticipate a dramatic drop in sales, with some stating that the United States accounts for up to 20% of their turnover. The expected revenue declines are estimated at 10–20%.

- Several respondents indicated that if the tariffs persist, they would be forced to reduce their workforce or even close operations. In addition, some companies have had to reconsider or halt planned investments. One notable case involved the redirection of equipment and production intended for the United States to another subsidiary, leading to the effective shutdown of a new South African facility.

- Manufacturers also expressed concerns about production uncertainty, especially where their product offerings are specifically tailored to United States market demand.

- While some companies acknowledged the existence of alternative markets, most noted that these are limited and already under pressure. Asian suppliers, particularly from China, are aggressively pricing into African markets, making it difficult to shift exports regionally.

- Furthermore, protectionist policies in other countries have made export diversification even more challenging.

- Several companies reported a trade diversion effect, where redirected global supply chains have led to increased competition from lower-priced imports in key third markets, eroding South African competitiveness. Even companies not directly exporting to the United States are bracing for spillover effects.

- Suppliers to exporters are anticipating reduced orders, while increased global steel prices and constrained access to key materials are expected to raise input costs.

- Respondents also flagged broader macroeconomic concerns, including rising inflation, decreased gross domestic product, and worsening unemployment.

- There is a general sense of uncertainty, with companies citing delayed orders, client hesitation and investor risk aversion as immediate consequences.

Several notable observations emerged from the responses

- While some companies reported being unaffected, others described the tariffs as an existential threat, underscoring the uneven exposure within the sector.

- There were multiple calls for government intervention through export diversification incentives, financial support and stronger trade diplomacy. Some respondents criticised broader industrial policy frameworks, arguing that structural issues such as high labour costs and electricity tariffs had already undermined competitiveness before the tariffs were imposed.

- Lastly, one respondent highlighted the adverse impact on emerging green technology, noting that their unique energy-efficient product, which had shown great promise, is now facing reduced demand due to the tariff-related uncertainty.

Preliminary conclusions

The 30% tariff imposition by the United States is expected to have a significant and multidimensional impact on the South African Metals and Engineering Sector. While not all companies are directly affected, the broader ecosystem — including suppliers, customers and competitors — face serious disruption.

Tafadzwa (Taffie) Chibanguza

SEIFSA CEO (Designate)