Metal recycling in Africa

The Middle East & Africa accounted for a share of 3.8% of the global metal recycling market in 2023, in terms of value. The market in the region is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa.

The metal recycling market in the region is projected to register a CAGR of 4.2% between 2024 and 2029, in terms of value. Saudi Arabia and the UAE are the key countries driving the region’s metal recycling market. Saudi Arabia’s government has committed nearly USD 71 billion to support its Vision 2030 goals, focusing on substantial investments in urban infrastructure and construction.

These investments drive the growth of the metal recycling market as manufacturers create innovative products. The Middle East’s strategic location at the crossroads of Asia, Africa, and Europe, along with a large population, fuels demand for residential construction. Global players are expanding in Africa due to the availability of cheap labor, favorable exchange rates, and moderate regulations. The Middle East & Africa’s proximity to Asia Pacific and Europe positions the region as an emerging hub for manufacturing facilities.

Economic growth

The region offers significant opportunities for foreign manufacturers. Its strategic location, coupled with ongoing infrastructure projects and government initiatives, is driving the demand for metal recycling. The global economy is currently at risk of entering a recession in 2024 due to several factors, including high levels of inflation, increased interest rates, reduced investments, and disruptions in global supply chains.

According to recent data from the World Bank, the Middle East & Africa region is expected to experience a significant slowdown in its economic growth. Specifically, the Middle East and North Africa (MENA) region is expected to witness a decline in economic growth, with projections indicating a growth rate of 3.5% in 2023, which is expected to decline to 2.7% in 2024. This regional economic slowdown is primarily attributed to the diminishing economic boom in oil export countries. Growth in these net oil-exporting nations is expected to decline to 3.3% in 2023 and 2.3% in 2024, from 6.1% growth witnessed in 2022. A slowdown in economic growth in the Middle East and Africa can impact the metal recycling market.

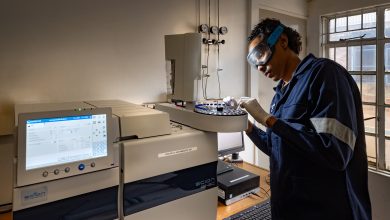

South Africa accounted for a 17.4% share of the metal recycling market in the Middle East & Africa in 2023. The market in the country is projected to register a CAGR of 4.5%, in terms of value, during the forecast period. According to the World Bank, as one of Africa’s largest economies, South Africa has seen its GDP growth rebound to pre-pandemic levels, with a 0.7% increase in 2023 and an expected average growth rate of 1.5% from 2024 to 2026.

Despite facing challenges like underdeveloped infrastructure and persistent inequality, the country anticipates sustained growth fueled by private investments in key sectors such as construction, transportation, and retail. South Africa’s robust GDP growth is further supported by its rich natural resources and government investments across various industries.