CustomEx, based in Hilton Pietermaritzburg, operating nationwide, consultancy for diesel rebate claims, has been observing the loss of millions in diesel rebate claims that mining companies are incurring due to errors in logging information (non-compliant logging). And for the challenge to be tackled effectively, the consultancy advises mining companies to adopt the proactive mindset of scrupulously addressing issues relating to compliance prior to a diesel audit.

Like their counterparts in the other parts of the world, South African mining and quarrying companies are continuously seeking ways of containing or reducing the effects of rising operating costs on their bottom-line. They are fortunate to have Diesel Rebate Claim Compliance Legislation, which affords them the right to submit records of their diesel usage to the South African Revenue Services (SARS) and get reimbursements (cash backs). Unfortunately, mining companies and quarries are losing millions in potential cash backs (through diesel rebates), as a result of lapses in record keeping, at best or, reluctance to submit due to the perception that the process required is onerous, at worst.

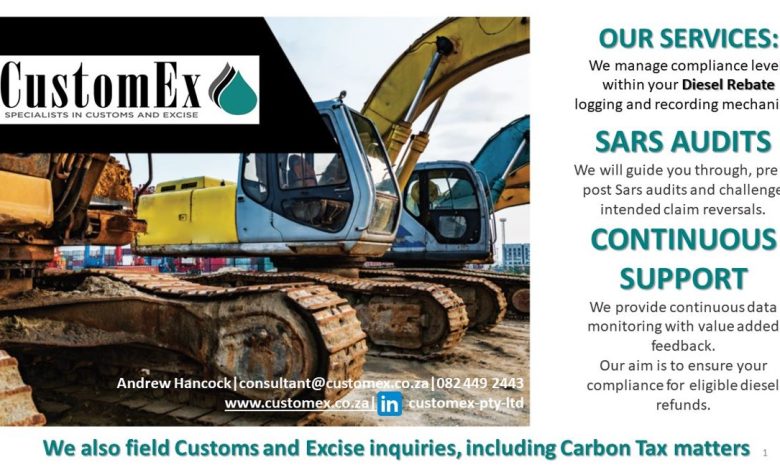

Andrew Hancock, a consultant from CustomEx, is concerned at how mining companies are missing out on making the most of the diesel rebate opportunity, the ‘low hanging fruit’ in cost saving. Thus, he informs them to improve the level of complaint logging and adherence to relevant legislation to maximise their eligibility. CustomEx is a consulting firm that specialises in helping clientele drawn from different sectors address rebate diesel claim challenges. CustomEx is an affiliate of Colenbrander Inc, an accounting and auditing firm, also operating out of Hilton.

Given the strong business case for compliant record keeping of diesel expenses, it is important to highlight common errors in mining companies’ claims and steps that should be taken for the claims to qualify for rebates.

At the outset, it is essential to appreciate the legislation governing how the rebates are to be made and what constitutes eligibility for claims.

The scope of legislation

Legislation allows certain industry sectors (referred to as ‘Eligible users’) to recover Fuel levy and Road Accident Levy from diesel purchases in accordance with certain legislated parameters. It defines activities that are eligible for rebate claim and those activities that are non-eligible. Essentially, a defined user registers for VAT purposes with sub registration for Diesel rebate purposes. Eligible “Users”, who are also economic contributors, are specified as follows: Onland Mining/Quarrying, Forestry, Farming, Commercial Fishing, Coastwise shipping, Offshore Mining, National Sea Rescue Institute, Rail freight, and Electricity Generation (Plants Specified). These activities are identified largely based on the fact that vehicles utilised are not essentially road users.

From a business or economic perspective, the diesel rebate system is aimed at protecting certain South African industries against international competition and some form of relief to diesel consumers who do not necessarily use roads. Diesel rebate claims can provide legitimate, substantial cash back as frequently as Value Added Tax (VAT) return submission.

Hancock shows how the rebate benefits the end-user: “Depending on a user’s diesel usage, the higher the volume, the higher the cash back. Basically, the diesel rebate system is aimed at providing relief to identified sectors who largely do not use roads. Frequency of your claim, currently ties in with the submission of your VAT return for your business. Next year, 2022, this mechanism is set to change to a standalone system. Draft legislation soon to be implemented will streamline the diesel rebate mechanism and, in some cases, ease the logbook requirements”

He explains that, in order to qualify for the diesel rebate, an organisation must register for Value Added Tax (VAT) and for the diesel rebate in terms of the Customs and Excise Act. “To qualify for the rebate and to be able to claim it back, the operation must be able to prove and calculate the amount of lawful consumption in terms of Schedule 6, Part 3 of the Customs and Exercise Act. The schedule lists the activities that qualify for the rebate, as well as how diesel usage must be recorded. The rebate is regarded as a ‘provisional concession’ until the quarry can prove reasonably that the diesel was used lawfully.”

Noteworthy, the frequency of a company’s claim ties in with the submission of the VAT return for a business. Thus, a defined user would need to be registered for VAT purposes with sub registration for diesel rebate purposes. Currently, South African Revenue Services (SARS) system is used to facilitate registration and the VAT return mechanism manages the claims on diesel used.

Common mistakes in logging

However, based on his experience from engaging with quarries, Hancock has noticed an oversight in how quarries approach logging of rebate claims. The common encountered challenge is that most of the information relevant to the diesel rebate is recorded but not compiled and presented in accordance with the required format, he points out. “Most have some form of record keeping but it does not conform to the specific requirements. For instance, claims are made on the purchase totals rather than the actual usage record (asset logging record), which is incorrect, or specific detail is omitted which impacts on eligible proof.”

Worse still, organisations tend to be more reactive than proactive when it comes to addressing the anomaly. They often reach out for assistance only when SARS make contact to set up an audit.

Those that feel disinclined to get the necessary help, the audit results in a massive reversal of claims. As a rule, the audit covers a two-year period. And when deficiencies are revealed, the entire period of is reversed and the whole amount becomes repayable.

“The financial impact of the reversals should not be underestimated and is relative to an organisation’s size. For small operators at the current rebate rate, this can equate to around US $13,300 R200 000). For some big operations, you could look at a tax bill of R6.3 million or more, depending on volumes of diesel used and claimed” stresses Hancock.

Put off by the perceived convoluted process involved, some organisations give up and stop claiming. Eventually, the assessment goes unchallenged and future claim benefits are voluntarily lost. Stressing that mining companies should not let huge sums of money, which they are legally entitled to, go unclaimed, Hancock states, “Diesel rebates are legislated and available for the benefit they were designed for. Challenging the audit findings can result in the recovery of some or all of the intended reversal.”

Proactive mindset required

Contrary to popular perception (or rather misconception), compliance is easier to realise with the right guidance. Hancock states that mining companies need to adopt the proactive mindset of scrupulously addressing issues relating to compliance prior to a diesel audit. “It all starts with the detail required in the logging record, and while this can be perceived as an administrative burden, the reality is that once the detail is identified, the system can be streamlined into your daily operations. Invariably, a tracking system already exists of necessity to the operators’ accounting needs. What it needs is a matter of tweaking and enhancing.”

Hancock indicates how larger and smaller operations can manage logging, “Larger operations will require a more structured approach owing to the volumes of diesel used, variety of activities performed, and number of assets being tracked. Smaller operations can slot a logging mechanism into daily activities. In all cases, original records are foundational and are the basis of your audit trail. Eventually, once an organisation has a secure system of logging inclusive of all compliant elements, there should be no need to fear a Sars audit.”

Simply put, fuel used must be logged, detailing how much, when, where and what for. Those key records will support or negate a claim. The activities performed become crucial to eligibility. Oftentimes Sars will dispute primary and secondary activities and raise assessments accordingly, even though the logging record in its criteria is compliant.

“At the end of the day, legislation is the empowerment of rights for both Sars, as the revenue collector, and yourself, as the taxpayer. When Sars intends, or in the event, reverses previous claims it is crucial to analyse what criteria they are basing their intentions on,” contends Hancock.

On the whole, once an organisation’s system is consolidated into a compliant format, which is maintained, its claims should remain secure and should successfully withstand Sars audit actions.

Valid business case

Beyond question, the significance of sound compliance to increasing the potential for successful rebate claims does not have to be overstated. There is a valid business case for improvement in record when one considers the numbers they entail, as Hancock demonstrates: “The volumes of Diesel used within the quarrying and Mining context is usually large. The cash back factor (on every VAT return) is significant. For example, if a quarry uses 100 000 litres in defined eligible activities, per month, 80% being 80 000 litres with the current rate of R3.66 applied, the rebate for one month would equate to around R292,800. For a two-month VAT period you would expect R585,600 refund. Compliant claiming also enhances the enterprises reputation and integrity with Sars especially when tax clearances are required, says Hancock, stressing that claim eligibility can be maximised by improving their level of compliant logging and adherence to the relevant legislation.