Marula Mining ends Europa Metals reverse takeover, reaffirms standalone critical metals strategy

Company shifts focus to building long-term shareholder value as an independent, Aquis-listed critical metals player

Marula Mining has officially called off its proposed reverse takeover transaction with Europa Metals, stating that the deal is no longer likely to be completed within the expected timeframe.

The African-focused mining and development company announced on 30 January that discussions with Europa had ended, despite efforts by both parties to advance the transaction. The reverse takeover, first announced in November last year [2025], would have involved Marula’s wholly owned subsidiary, Marula Africa Mining Holdings, being acquired by Europa in exchange for shares.

Following the termination, Marula said it now believes it is better positioned to deliver value as a standalone, Aquis-listed company with a focus on critical metals. The group added that this strategy offers long-term shareholder value and continued access to capital markets.

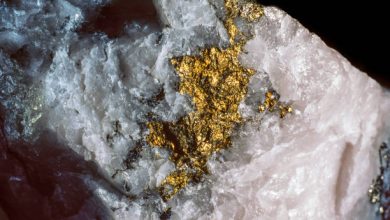

The decision brings to an end a proposed transaction that would have provided Europa shareholders with exposure to a diversified portfolio of producing and near-term producing mining assets across East and Southern Africa. These assets included the Blesberg lithium and tantalum mine in South Africa, the Kinusi copper mine in Tanzania, and the Kilifi manganese processing plant in Kenya, alongside a pipeline of earlier-stage battery and critical metals projects.

Under the original proposal, the transaction would have constituted a reverse takeover under AIM rules and would have required Europa to apply for the re-admission of its shares to the AIM market. The deal was also subject to several conditions, including due diligence, shareholder approval and a successful fundraising.

Marula further confirmed that its existing strategy centred on a precious metals-focused business, referred to as Old Marula, will continue as a standalone entity. At the same time, the group plans to move forward with recent and planned mine developments, strategic acquisitions and other corporate initiatives aimed at building what it describes as a high-value critical metals portfolio aligned with the global energy transition.

The board said it remains confident that these steps position Marula to benefit from growing global demand for critical metals, while unlocking further value from its current operations.