South African Gold and PGMs a Strategic Priority for Sibanye-Stillwater, Says CEO

CEO outlines resource optimisation, mechanisation and sustainable growth across SA assets

South African gold and platinum group metals (PGMs) remain central to Sibanye-Stillwater’s long-term growth strategy, with renewed focus on optimising resources, enhancing margins, and unlocking value across its existing portfolio.

This was underscored by Sibanye-Stillwater CEO Dr Richard Stewart on Thursday, January 29, when he outlined new organisational structures, operational priorities, capital allocation plans, and expected implementation outcomes. The JSE- and New York-listed miner is one of the world’s largest primary producers of platinum, palladium, and rhodium, alongside its gold operations, positioning the company favourably amid record-high gold and platinum prices.

“South African gold is a strategic priority, and that includes the Burnstone project, and South African platinum group metals (PGMs) are certainly strategic priorities and that includes a number of PGM projects,” Stewart said.

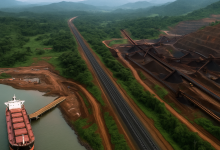

Sibanye-Stillwater’s strategy is anchored on three metal supply streams: primary mining, secondary or waste mining, and recycling.

“We have three sources of metals that we provide the market. One is our primary mining, the other is our secondary or waste mining, and the third is recycling. Primary mining is the only way you can grow the pie. So that’s critical to our strategy. Secondary mining is probably the only form of getting hold of a metal where you can have a net positive environmental impact.”

Stewart highlighted that secondary mining allows value extraction from previously mined surface dumps as processing technologies and economics improve.

“When we look at our secondary mining, DRDGOLD remains a strategic priority for us. We don’t manage it. It has its own management team, but that remains very strategic to the business, and then our recycling operations, which are currently being consolidated into a single business, we are evaluating and re-evaluating carefully, and some of these have got feasibility studies which are currently being completed.”

He emphasised the need to reverse traditional mining cost cycles, warning against extracting finite resources at low margins.

“These are the trends that need to be reversed. You want to mine more with higher margins and less with lower margins. Do not extract the finite resource when you’re making money.”

Stewart described this shift as a core element of Sibanye-Stillwater’s future operating philosophy.

“And how do you tactically get that embedded within your operating psyche, within your planning and within your flexibility? That is resource optimisation, and that is something that we’re going to be driving hard going forward.”

Sustainability and people remain critical pillars of the group’s strategy.

“Finally, sustainability. I think we again as geologists, as engineers, as miners, regard this as the soft, fluffy stuff that it most certainly is not… The strength of our tree is our people and continuing to foster a culture of care, a culture of performance, a culture that embraces what I call the Sibanye spirit.”

Looking to growth, Stewart said the strongest opportunities lie within the company’s existing asset base, particularly its South African PGM operations.

“Looking at the growth side, the best opportunities we see for growth at the moment are within our own portfolio, and within that portfolio, the highest priority will be at our South African PGM operations.”

He explained that the consolidation of contiguous assets between 2016 and 2018 unlocked significant value.

“When we put these operations together… we were able to realise about R3-billion rand a year’s worth of synergies.”

Further value has since been unlocked through mechanisation and the integration of UG2 resources previously constrained by mine boundaries.

“We have just unlocked a significant amount of resources – UG2 resources; mine mechanised that which was never previously considered… That’s the value of putting continuous assets together.”

At Marikana, pooling chrome assets through engagements with the Glencore Merafe JV has accelerated value realisation and enabled access to high-quality shallow PGM resources.

“These are shallow resources on strike mined from surface in a mechanised way… the UG2 reef… on our operations has anywhere between a 20% to 30% higher revenue per ton than the Merensky reef.”

“These are the orebodies of the future in PGMs,” Stewart said, adding that four mechanised projects are currently under evaluation across existing operations.

Processing flexibility has also improved following the renewal of a key contract.

“We have very recently been able to renew the contract we have with Valterra, and that gives us significant flexibility on the timing and how we can bring these projects to work.”

Stewart concluded by reaffirming the profitability of secondary mining opportunities.

“Those already mined dumps very profitably,” Stewart said.