Analysis of the economy & budgetary events in the context of the construction sector AfriSam

By: Dr Azar Jammine Director and Chief Economist Econometrix Pty Ltd.

Hopes for improved growth

- Cessation of load-shedding

- Confidence from the formation of GNU

- Improved oversight of corrupt practices

- More cooperation between government & private sector

- Fast tracking by some ministries

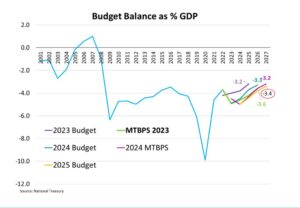

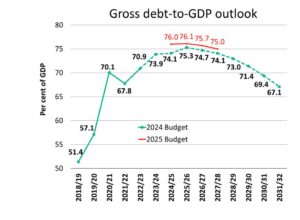

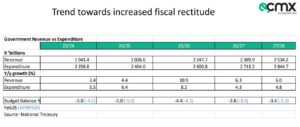

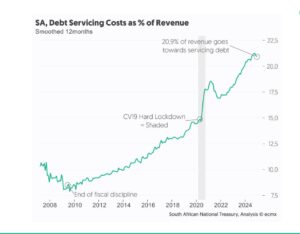

- Adherence to fiscal rectitude

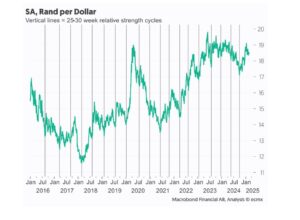

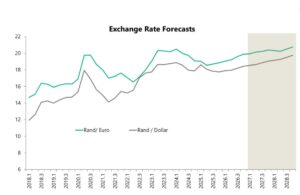

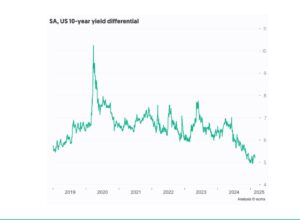

- Rand strengthens moderately

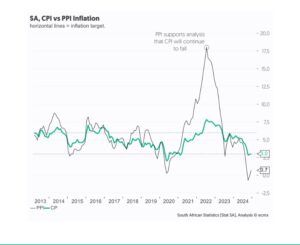

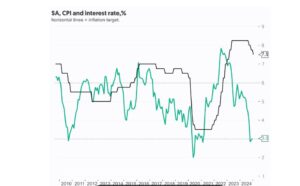

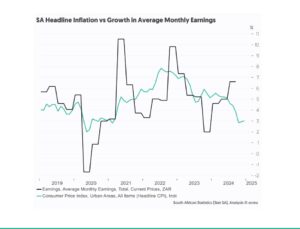

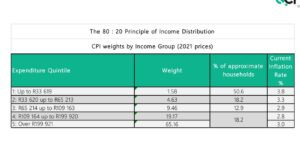

- Lower inflation than expected

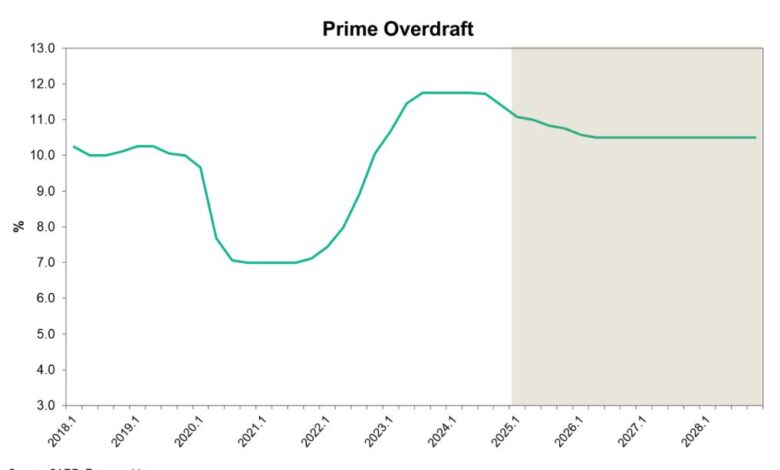

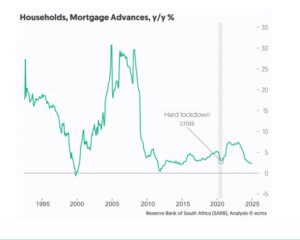

- Interest rates falling

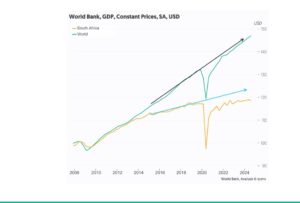

- Institutions revise SA growth upwards by about 0.5%

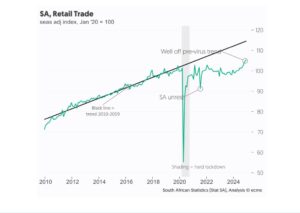

- Stimulus from two-pot retirement scheme

Domestic Risks

Risks

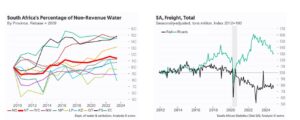

- Logistical bottlenecks continue

- Fallout from Mozambique unrest

- Opposition to private/public partnerships

- Breakup of GNU, a possible risk

- Opposition to GNU from within the ANC

- Disarray and incompetence at municipal level

- Failure to address more deep-seated structural impediments

- Negative fallout from Trump administration:

- Vis-á-vis SA

- Vis-á-vis Global economy

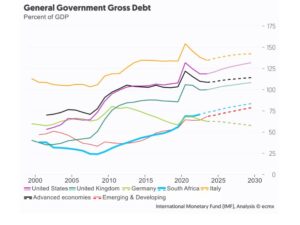

- Global long-term interest rates to remain elevated

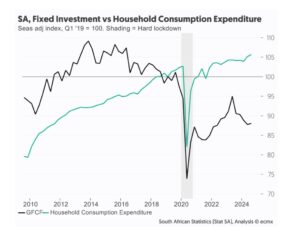

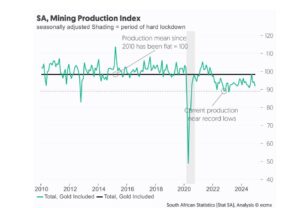

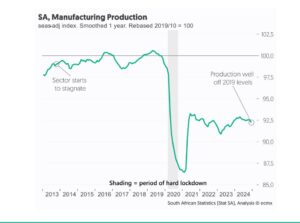

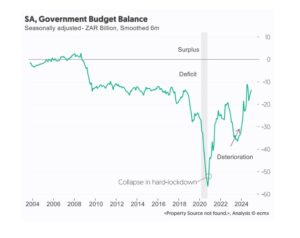

Thus, far little sign of significant growth pickup

Positives & Negatives from Budget Postponement

Positives:

- Reflection of vibrant democracy at work

- Message to ANC that it has to consult GNU partners

- Budget impasses common in coalition governments

- Problem has arisen from attempts at fiscal austerity, not populism

- Credit rating agencies might be impressed by this

- Spat assists in recognition of dilemma of overspending

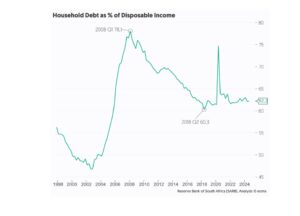

- Hiking of VAT rate would have withdrawn R50bn from consumers

- No reference to NHI

Negatives:

- It appears as if the ANC failed to consult GNU partners until late

- Challenge of finding alternative revenue sources

- VAT exclusions and no fuel levy increase neutralised effective 2% hike

- Problem is inability to control spending

- Public sector wage budget hiked by R23.4bn over three years

- SRD grant retained for another year

- Child Support and other grants increased by more than inflation

Conclusion:

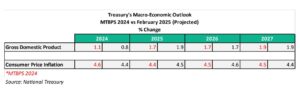

- Sustainable growth will remain elusive until higher growth generated

- Dealing with structural impediments critical long-term

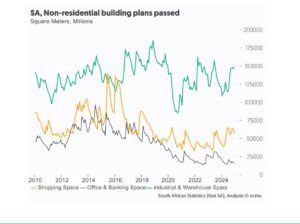

- Translation of infrastructural investment into reality critical

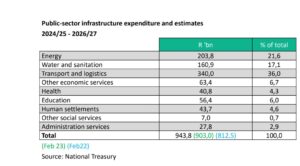

Infrastructural Intentions in the Budget Speech

• Capital payments, which is money allocated for the purchase or upgrade of long term assets like buildings, machinery and equipment are the fastest growing area of spending by economic classification

• Over the next three years, public infrastructure spending amounts to more than R1tn

• R402bn for transport and logistics

• R219bn for energy infrastructure

• R156bn for water and sanitation

• SANRAL to spend R100bn “over the medium-term”:

• Roads kept in active resurfacing contracts from 950 km in 2024/25 to 2000 km in 2025/26

• SANRAL will increase strengthening and improvement of network from 200 km in 2024/25 to 400 km in

2026/27

• Provincial roads departments will reseal over 16,000 Lane-kilometres of roads

• Every R1m spent on construction creates more than three jobs for individuals with no more than Matric

• Construction of Mkhomazi Project to commence Nov 2026, transferring water to Mngeni Water Supply System, supplying 5m households

• Credit guarantee vehicle to be launched in H1 2026

Fears over Trump’s Impact on SA

- Aid withdrawal

- Pushback on SA foreign policy stances

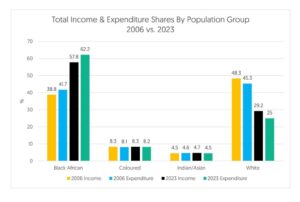

- Pushback on expropriation and BEE – note that Rand weakened in response to the strong Dollar due to Mexico & Canada tariff announcement rather than Trump’s SA tirade

- Retaliation for SA’s reporting of Isreal to ICJ

- Impact on AGOA would affect motor & wine industries and some fruit exporters – but not huge relative to total

- AGOA impact more than 3% of SA exports

- Far bigger impact is on desire of Americans to invest in SA

- However, trade relations with other countries to open up

- Ironically, Rand strengthened by 2% last week

Conclusion

- Much of the impact of the deteriorating US/SA relations had already been discounted in Rand’s depreciation in 2022 & 2023

- Budget has important role in highlighting fiscal rectitude or not